Making sense of Blockchain

Trust is fundamental to commerce. Any business transaction is based upon trust and requires secure way of transferring assets between transacting parties. Banks provide this trust by maintaining a true record of financial transactions. Government agencies provide evidence of land titles, vehicle registration records, health and education records etc by maintaining a transaction log. They provide trust by maintaining a central ledger for recording transactions that can be relied upon to verify each transaction. The onus of maintaining the transactions accurately and securely on the central ledger also lies with the authority owning it. This grants significant responsibility and control to the central authority or intermediary facilitating commerce between transacting parties. The intermediary essentially establishes the rules of commerce that every transacting party must adhere to. While the intermediary often operates effectively, it can occasionally become a single point of failure, as seen in the global financial crash of 2008 where banks were at the epicenter of the economic turmoil.

- Can a centralised authority with utmost power be trusted to run and meddle with entire economic systems?

- Could the monetary supply and monetary policy be set by a computer where it could not be corrupted by humans, thereby preventing government overreach?

- Is the transaction ledger owned by the central authority tamper evident and prevent any illegitimate records being added or updated? Is it independently and transparently verifiable in case of a dispute?

- Are the intermediaries efficient in fulfilling monetary transactions? Communication over the internet takes place at a mind boggling rate but systems with layers of middlemen can take days to clear and reconcile.

What is blockchain?

Shortly after the 2008 global financial crisis, a white paper by an unknown entity Satoshi Nakamoto emerged. The paper introduced a new peer to peer financial system where payments are based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party. The system would use a new digital crypto currency called Bitcoin. The technology invented to power this new system was called blockchain. Simply put, a blockchain is a continuously updated decentralized record of who holds what.

Decentralized trust and control

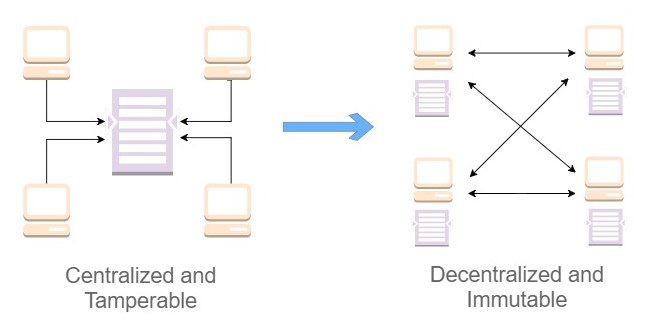

Blockchain transfers control and decision-making from a centralized entity (individual, organization, or group thereof) to a distributed network. Decentralized networks strive to reduce the level of trust that participants must place in one another, and deter their ability to exert authority or control over one another in ways that degrade the functionality of the network. Blockchain attempts to reduce the cost and increase trust in business transactions by using an immutable distributed transaction ledger on peer to peer networks rather than a central ledger. Rather than a single authority like a bank responsible for maintaining transactions, it is now a group of people running blockchain software that do this. They ensure that the information stored in the distributed ledger is immutable and verifiable by applying techniques like cryptography and hashing. The list of transactions, also known as a distributed ledger is available for everyone to see and verify. The distributed nature of the blockchain makes it tamper evident and unhackable because if a block of transactions is messed with, everyone gets to know about it and as long as the bad actors are outnumbered by the good ones it is rejected by the system. Trust is inherently built into the system.

Underlying technology

-

Asymmetric cryptography using digital signatures A way to verify that a message was sent by the known sender, that the only way some one could have produced it is if they knew the private key, associated with the public key that you used to verify the message.

-

Peer to peer network A ledger containing the record of all the messages is copied on a group of computers rather than relying on a single authority to maintain the records on a central computer. This decentralization removes the need to trust a single authority but with as many copies of the ledger as the number of computers in the network, which version of the ledger is to be trusted? This is the problem addressed in the original Bitcoin paper. The solution offered is to trust whichever ledger has the most computational work put in to it.

-

Cryptographic hashing A way to generate a small, unique “fingerprint” for any data allowing quick comparison of large data sets and a secure way to verify data has not been altered. Some computational work must be carried out to generate the fingerprint or hash in the desired format and update the decentralized ledger. This is known as Proof or Work.

How do we ensure the rules are being followed?

-

Group of people who maintain the distributed ledger are called bookkeepers. Transactions often reach different bookkeepers in different order, depending upon which bookkeeper is online. Bookkeepers need to agree on the order of transactions and rules about money creation, version of software to run and the transaction formats.

-

Periodically bookkeepers are allowed to add money to their own accounts, thereby creating money out of thin air. But this is only allowed according to very constrained rules. Those rules include a very slow gradual rate of money creation, until no more money can be created.

-

Math based voting system to determine what the majority thinks. Bitcoin requires bookkeepers to solve a very special math problem to vote. This is called “Proof of work” explained in the Bitcoin white paper “one vote per CPU” instead of one vote per person.

-

Voting is allowed to happen every 10 minutes to allow all bookkeepers to stay synchronized. Each new group of transactions that gets approved is called a block and these blocks are grouped together in a chain called the blockchain.

Where can blockchain be applied?

You can use the FITS model - Fraud, Intermediaries, Throughput, Stable data to understand the possibility of using blockchain applications in a particular environment. This could include

- Fraud - an environment which has a history and likelihood of fraud involved in various transactions, making international payment providers early adopters of blockchain.

- Intermediaries or middle men - areas where there are a lot of intermediaries involved who do not provide a lot of value, the application of blockchain can reduce transaction times from days to minutes by taking the middle men out.

- Throughput - environments with high throughput or number of transactions per second (tps). Bitcoin, currently can only process 7 transactions per second. Visa processes around 1,700 transactions per second on average, claiming to be able to support 24,000 tps. Mastercard utilizes a network that claims to handle around 5,000 tps. Researchers are working on increasing the Bitcoin throughput.

- Stable data - For a blockchain application you do not want volatile data, rather you want things that are going to stay the same for a while e.g. land ownership titles and personal information.

Impact on financial services

Bitcoin is the best-known application of blockchain technology. The prevailing view is that blockchain will cause two main shifts in the way banks do business

- The first is in its broad potential to bring financial institutions closer together and make global collaboration easier.

- Due to the lack of trust, very little data is shared amongst financial institutions. Blockchain reduces this trust deficit and can allow seamless transfer of digital assets within a business network and better sharing of data across businesses.

- Creation of secured, shared data with common standards - a public distributed ledger that allows automatic synchronization and removes inefficiencies due to variations in internal processes and data formats within the systems at different institutions.

- The second is by creating real efficiencies in the way the bank processes data.

- Simplification of payments infrastructure, the use of smart contracts to standardise post-trade processes without having to rely on a central certifying authority, and efficiently connecting parties in trade finance and syndicated lending by reducing the need for reconciliation at both ends of the business (purchaser and supplier).

Impact on Public Key Infrastructure (PKI)

The most commonly employed approach to Public Key Infrastructures (PKIs) is the Web PKI. It is a Certificate Authority (CA) based system that adopts a centralized trust infrastructure. Communications over the internet are secured through the safe delivery of public keys and the corresponding private keys. PKI has been the backbone of Internet security since its inception through the use of digital certificates.

However, there are problems with centralized PKIs such as CA-based systems. Because of the ability to impersonate another user or a website, CA systems are well-known targets for hackers. If they get hacked you get hacked. By breaching them, the bad guys gain access to a treasure-trove of personal and financial information traveling on the Internet. DigiNotar a Dutch CA whose systems were attacked and many fraudulent certificates issued had to eventually file for bankruptcy. CAs are a single point of failure that can be exploited to compromise encrypted online communication. Blockchain acts as a decentralized, open and transparent key-value store and eliminates traditional PKI vulnerabilities. It is capable of securing data to prevent MITM (Man-in-the-Middle) attacks, and to minimize the power and fragilities of third parties.

Impact on IOT

Today we transact not only with humans but machines and smart devices. How do we trust all the new IOT devices that are coming online? One prediction suggests that by 2020 we will have 7 times more smart devices than we have human beings in the world. That’s about 50 billion devices in 2020 that we’ll have to transact with and that we’ll have to trust. In 1982, a compromised software in the Trans-Siberian pipeline that controlled pump speeds and valve settings, produced pressures far beyond those acceptable to the pipeline joints and welds. This led to a three-kiloton, non-nuclear explosion so big that it was seen from space. There are centralized PKI based solutions to securing IOT device communications, however they are still prone to problems of centralized trust. Blockchain provides a decentralized PKI alternative by adopting given enough eyeballs, all bugs are shallow approach. This allows

- Securely sharing any information between machines, including connected vehicles, smart appliances, or manufacturing equipment in a decentralized manner without depending upon a single third party to secure your entire system.

- Providing open and transparent scrutiny to the adopted PKI security controls and protocols.

- Reacting fast to misuse by revoking certificates by making the process transparent, immutable, and prevent attackers from breaking in, thus effectively avoiding the MITM attacks.